Why Should I Pay Tax - Honest Taxpayer feels cheated in India

- Trewards

- Nov 4, 2023

- 3 min read

Before I talk about anything , here is one of the tweet by a Bengaluru taxpayer showing his frustration of being an honest taxpayer on twitter

Being a responsible and law-abiding citizen, I have always taken pride in being an honest taxpayer. I believe in contributing my fair share to support the nation's development, infrastructure, and social welfare programs. However, as the years have passed, a growing sense of frustration and disillusionment has set in. I can't help but feel cheated for being a diligent taxpayer. In this blog, I'll share my thoughts on why I feel Why Should I pay tax and why it's essential for our system to address the concerns of honest taxpayers like me

Lack of recognition for Honest Taxpayers

Honest taxpayers are, in many ways, silent contributors to the nation's progress. Their financial contributions fuel the government's initiatives, public services, and infrastructure development. However, these contributions often go unnoticed, leaving them feeling undervalued and underappreciated.

One of the significant issues is the disparity in acknowledgment between those who diligently pay their taxes and those who engage in tax evasion. While tax evaders often escape scrutiny, honest taxpayers bear the weight of the nation's financial needs, all the while receiving little recognition or appreciation

Governments should consider incentivizing tax compliance through various means, such as offering tax rebates, certificates of recognition, or public acknowledgments. These initiatives can help bridge the recognition gap .

The Taxpayer to Population Ratio

With over 1.3 billion people, India is one of the most populous nations globally. Yet, the percentage of individuals who actively contribute to the direct tax base is staggeringly low (~5%) . This phenomenon can be attributed to various factors, including a large informal sector, widespread tax evasion, and a lack of awareness about tax obligations.

Unequal Burden of Taxes

The burden of financing public goods and services falls disproportionately on the shoulders of the 5% who do pay taxes. This situation creates an imbalance, as a significant portion of the population benefits from government initiatives without directly participating in funding them. For Ex : People earning from Agriculture don't come under direct income tax even if they are earning high and are rich .

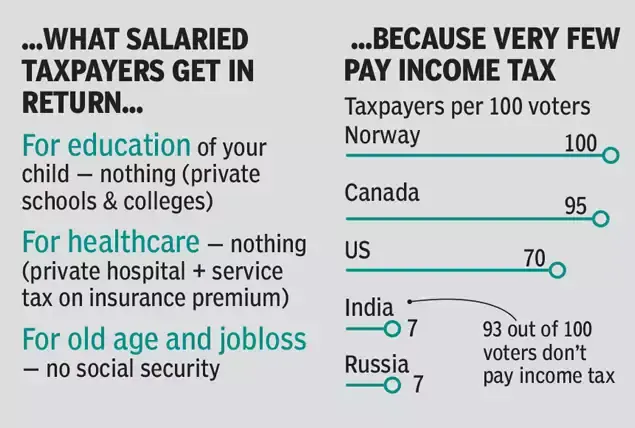

What salaried taxpayers gets in Return

There is often a feeling that salaried taxapayers don't get anything tangible in return . Salaried taxpayers, the backbone of any nation's economy, diligently contribute a significant portion of their earnings to the government in the form of taxes. While it's often seen as a civic duty, the furstration also growing within salaried taxpayers that what they get in return for their contributions by shouldering the responsiblity of such a large nation .

Here is a snippet I took from the article India’s most abused taxpayers which talked about something similar

Lack of Civic Amenities

Despite contributing our hard-earned money to the nation's coffers, honest taxpayers often face challenges when it comes to basic civic amenities such as clean streets, safe public spaces, and well-maintained infrastructure. We deserve to see our contributions translate into a better quality of life for all citizens .If more people were involved in paying direct taxes this would have been improved a lot and would have translated into a better place to be in .

Conclusion

While there are more reasons which we will probably cover next time . As an honest taxpayer, my frustration and feelings of being cheated are born out of a desire to see a fair and just system. I do not resent paying taxes; I resent the lack of accountability, transparency, and fairness in the system. It's time for India to recognize the importance of its honest taxpayers and address their concerns to build a more equitable and prosperous nation. We hope that in the future, our contributions will be acknowledged, and the system will evolve to truly represent the values of honesty and integrity .

In order to solve this issue , I am building Trewards ( https://www.trewards.in/), a community of honest taxpayer where like-minded individuals can contribute towards each other’s growth by sharing their own learnings on tax savings and also getting rewarded by the platform by various initiatives .If you are one of those and want to be rewarded for being an honest taxpayer , you are welcome to join the community .

What do you think , an honest taxpayer should be rewarded ?

Yes

No

Disclaimer: This material is just meant to provide general information and is published in the interest of the entire public. The article's contents are personal view and should not be taken as definitive advice, thus readers are urged to use caution. Readers should conduct more research or speak with a specialist in this area. The information contained herein is subject to updation, completion, revision, verification and amendment and the same may change materiallyies . Misuse of any intellectual property, or any other content displayed herein is strictly prohibited.

Comments